Windows 2000 and above

Windows 2000 and above| Rate this software: | |

| 387 downloads | |

View Screenshots(1)

View Screenshots(1) Comments

Comments

| Rate this software: | |

| Share in your network: |

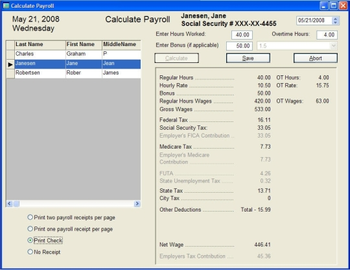

Payroll Master 2.0 provides a way to create your payroll records. Payroll can be weekly or bi-weekly pay periods. After entering your business and employee information, creating your payroll is as easy as selecting the employees name from a list and entering the hours worked. Payroll Master will calculate for bonuses and overtime, and you have a choice of up to three payroll deductions from your employees. They can be tax deferred such as a 401K plan, or non-tax deferred as in a Roth IRA. Payroll Master will calculate taxes for the self employed too. A payroll receipt can be printed using regular paper, or print your payroll checks and receipt on standard pre-printed checks. Automatically calculate vacation time, sick and personal leave time based on a qualifying pay period. Reports for your accountant are a snap to create. There is a choice of printing weekly, monthly, quarterly, or annual reports for all employees or for just one individual.

Version 2.1.1.0 may include unspecified updates, enhancements, or bug fixes.

Whats new in this version:

Version 2.1.1.0 may include unspecified updates, enhancements, or bug fixes.

| $49.95 | Click the link to buy | Buy |