Windows 2000 and above

Windows 2000 and above| Rate this software: | |

| 1638 downloads | |

View Screenshots(1)

View Screenshots(1) Comments

Comments

| Rate this software: | |

| Share in your network: |

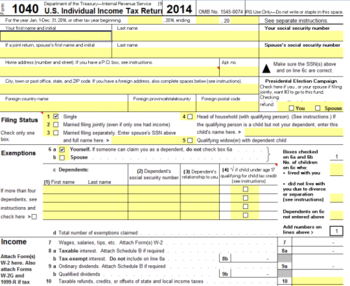

Your sources of income, deductions, capital gain transactions as well as partnership and S corporation income are entered on separate worksheets. The data from these worksheets is then automatically entered into the correct forms. Tax Assistant for Excel helps you determine whether to itemize deductions, automatically calculates your tax and provides a computerized record of your tax filing. The program also provides an automated Schedule D and Form 8949 preparation that is especially helpful for active traders and other taxpayers with a large number of trades to report. The program allows you to easily enter or copy and paste your trades into the Capital Gains sheet and print out a Schedule D attachment as a substitute for preparing multiple Form 8949s, although the program will prepare up to 100 Form 8949s. In addition to the more common income reporting, you can report income from up to five different businesses, rents, royalties, estates and trusts, as well as income from partnerships and S corporations.

Whats new in this version:

Version 5.5 was updated for the 2016 tax year and adds capital loss carryover functionality and income & deduction data entry constraints.

| $15.95 | Click the link to buy | Buy |